HSBC Global Money and Concept Innovations: Cross-Border Currency, Fast Payments, and the Next Generation of Mobile Banking.

Between 2018 and 2020, I worked within HSBC's Mobile X / Smart Channels team on two significant streams of mobile banking design. The first was Global Money, a cross-border account enabling customers to send, convert, and spend in up to 36 currencies without fees. The second was a set of mobile banking concept explorations, referred to internally as Northstar projects, which focused on rethinking HSBC's app experience through prototyping, experimentation, and stakeholder collaboration. This unified case study combines both streams to demonstrate the breadth of my contributions across product, research, design, and concept innovation.

Project Length

2018-2020

Team

Mobile X / Smart Channels

Platform

Native iOS & Android

Setting the Challenge

Managing money across borders was a long-standing pain point for HSBC customers. International transfers carried fees, conversion workflows were fragmented, and account screens didn't reflect how people actually thought about money. HSBC needed a new experience that would unify these actions while remaining compliant with complex global regulations.

Research & Discovery

We began by studying competitor wallets and transfer services, then conducted card sorting exercises to understand how customers mentally grouped financial tasks.

The unmoderated sort produced inconsistent results — users lacked context and scattered actions across unrelated categories.

Card Sorting Exercise

How users naturally group banking actions

Actions that clustered above 66% agreement formed the final groupings

View Information

4 actions

Move Money

4 actions

Manage & Convert

2 actions

Key Finding

"Send Money", "Add Money", "Withdraw Money" and "See Payees" clustered together naturally as "Move Money" actions.

Design Insight

"Convert" was seen as distinct, separate from other money movement actions at the 66% agreement threshold.

In the moderated sessions, clear patterns emerged. "Payments" and "Transfers" clustered together naturally as "Move Money". By contrast, "Convert" was seen as a distinct action by half the participants, highlighting how currency conversion is viewed differently from spending.

These insights were crucial in shaping the information architecture of the Global Money account screen.

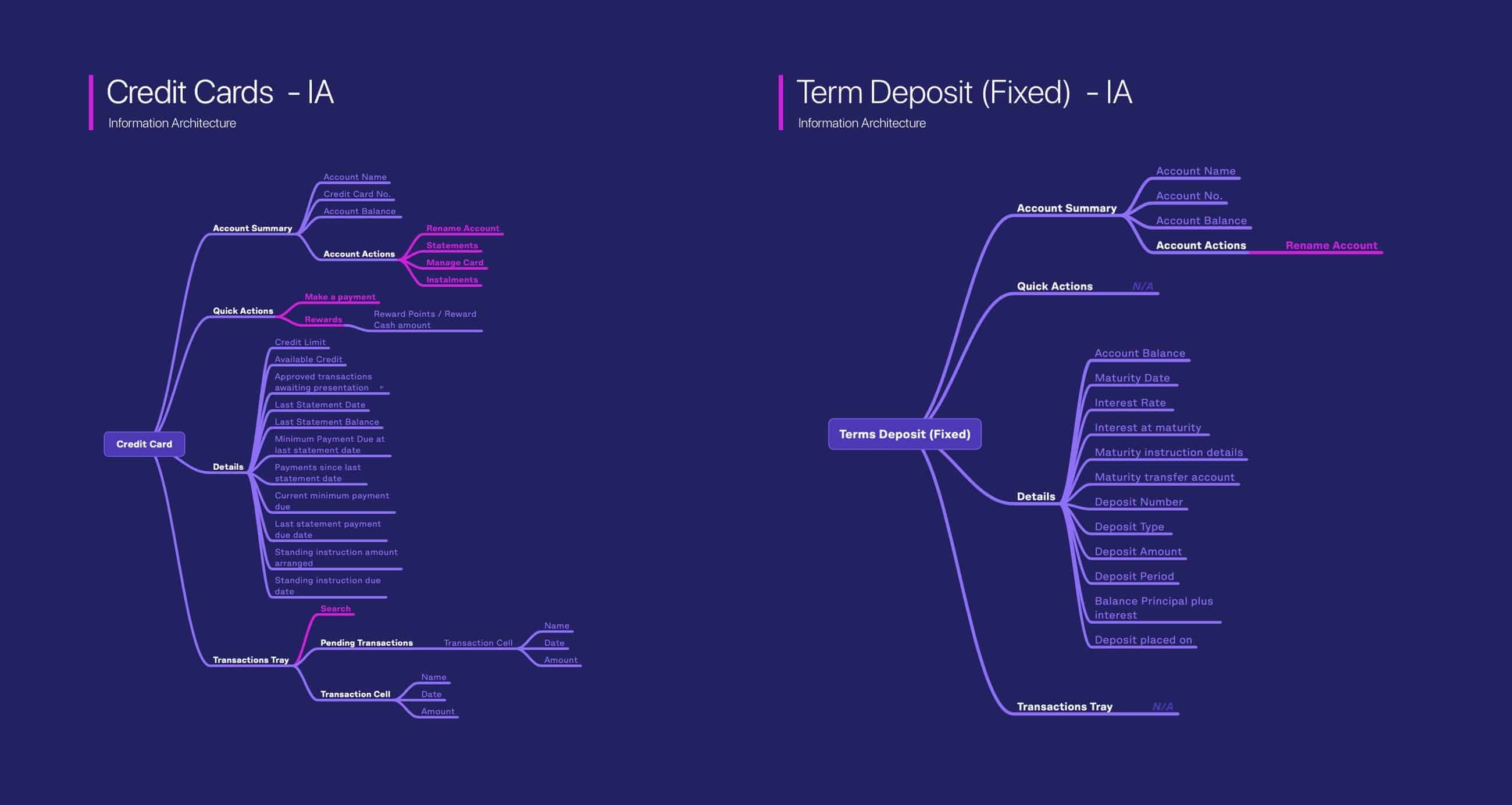

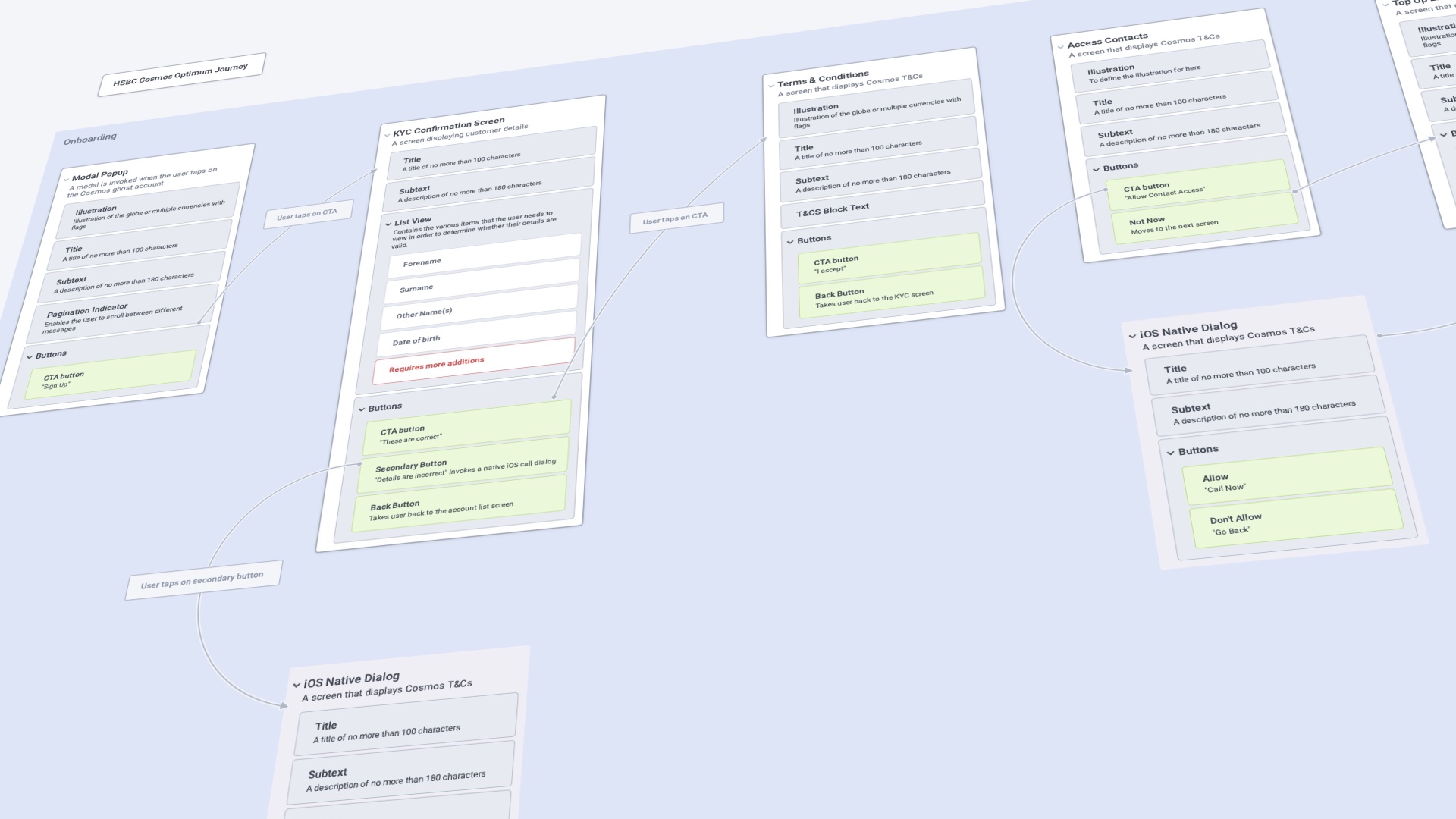

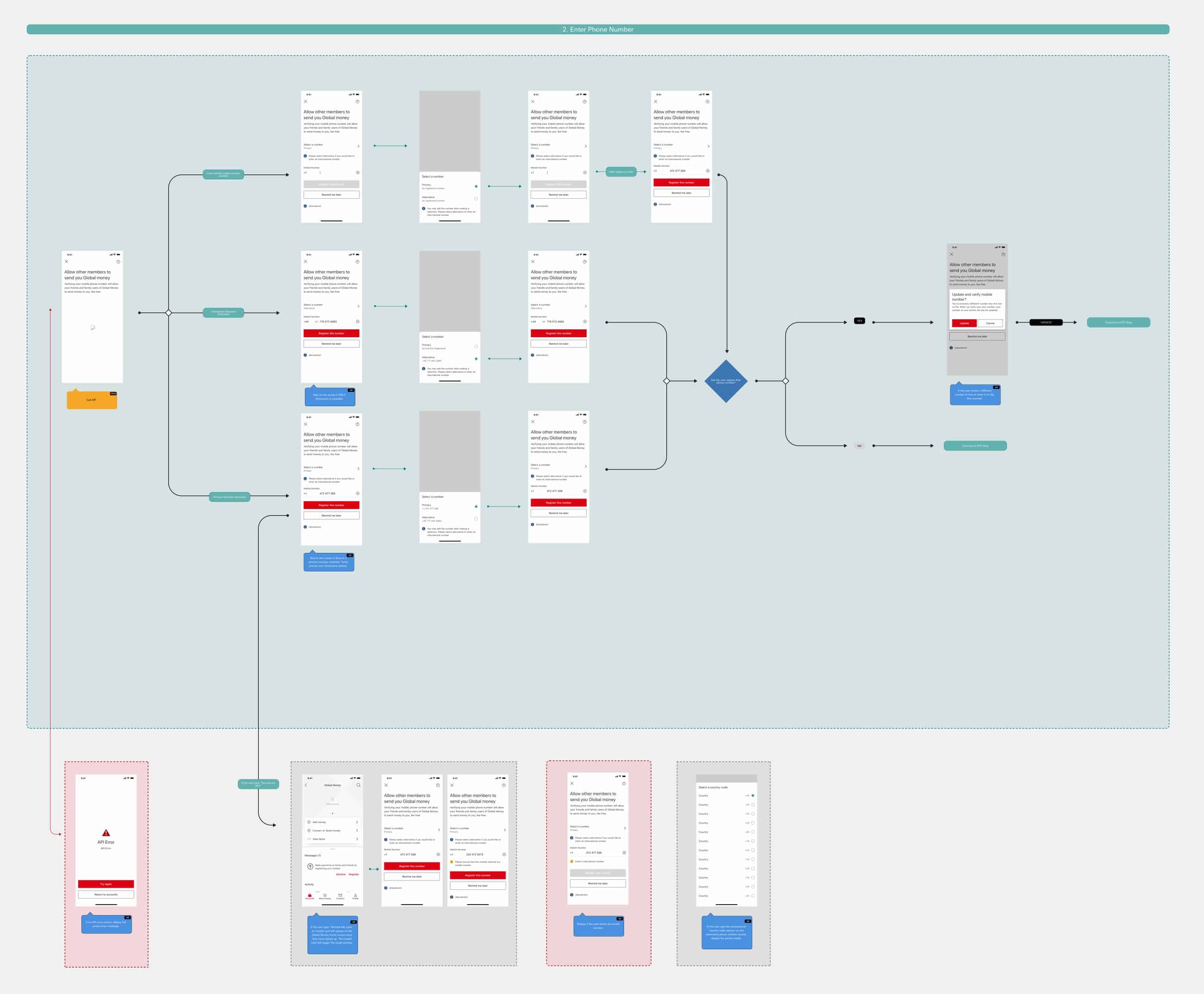

Information Architecture and Journeys

From this research, I mapped a detailed account IA and created journey flows for both successful and failed transactions:

Happy paths covered straightforward transfers, conversions, and card payments.

Unhappy paths captured regulatory blocks, API errors, and insufficient funds.

By visualising both, I helped product and engineering teams anticipate edge cases early, ensuring the final product would feel seamless even when things went wrong.

Wireframes

Before designing anything, I initially began to put wireframes together. These wireframes would display key user decision points and clearly illustrate happy paths vs unhappy paths as well as potential API errors.

Design

The UI was created using Sketch and using as much of the existing design system components that were in place. I worked closely with digital governance, brand and developers to ensure that we deliver an accessible experience to our users. Our designs were subject to strict quality control checks to ensure that they passed accessibility & worked well with screen reader for individuals with eyesight disabilities.

Onboarding

I wanted to provide an engaging and visual onboarding experience, while also ensuring that the user was educated about the product on their way through their journey, and why we required certain permissions.

Order Card

Ordering a card is optional for our users, again, I wanted to ensure that I provided a visual and engaging user experience, this was achieved by animating a slight reflection effect on top of the card, adding slight motion can often make dull pages appear more exciting.

Transaction Enrichment

As the new product had access to enhanced APIs, this allowed me to add transaction enrichment to our product. There were several complexities with enrichment, and this prompted a new research piece to be created.

Search Transactions

As the product was designed to be used cross borders, we were required to provide powerful searching tools to our users, which would allow them to search across different locations, currencies, and dates.

Collaboration and Delivery

I worked closely with API architects, compliance specialists, and developers to ensure the design could operate across multiple markets with different regulations.

Cross-functional Workshops

Regular design reviews with API architects and compliance teams

Technical Alignment

Ensuring design intent matched technical feasibility

Multi-market Compliance

Designs adapted for different regulatory requirements

Outcome

Global Money Launch 2020

Competitive new wallet product for HSBC

Send, convert, and spend globally with clarity

Fully accessible experience meeting WCAG standards

Resilient design supporting multiple currencies

The experience empowered customers with confidence in their global transactions, supported by a polished and resilient interface.

Global Money by the Numbers

A truly global solution designed for international customers

0+

Supported Currencies

Send, spend, and convert money across major global currencies

0

Active Users

Trusted by customers worldwide for

seamless cross-border transactions

0+

Markets Served

Available across major international

markets and growing