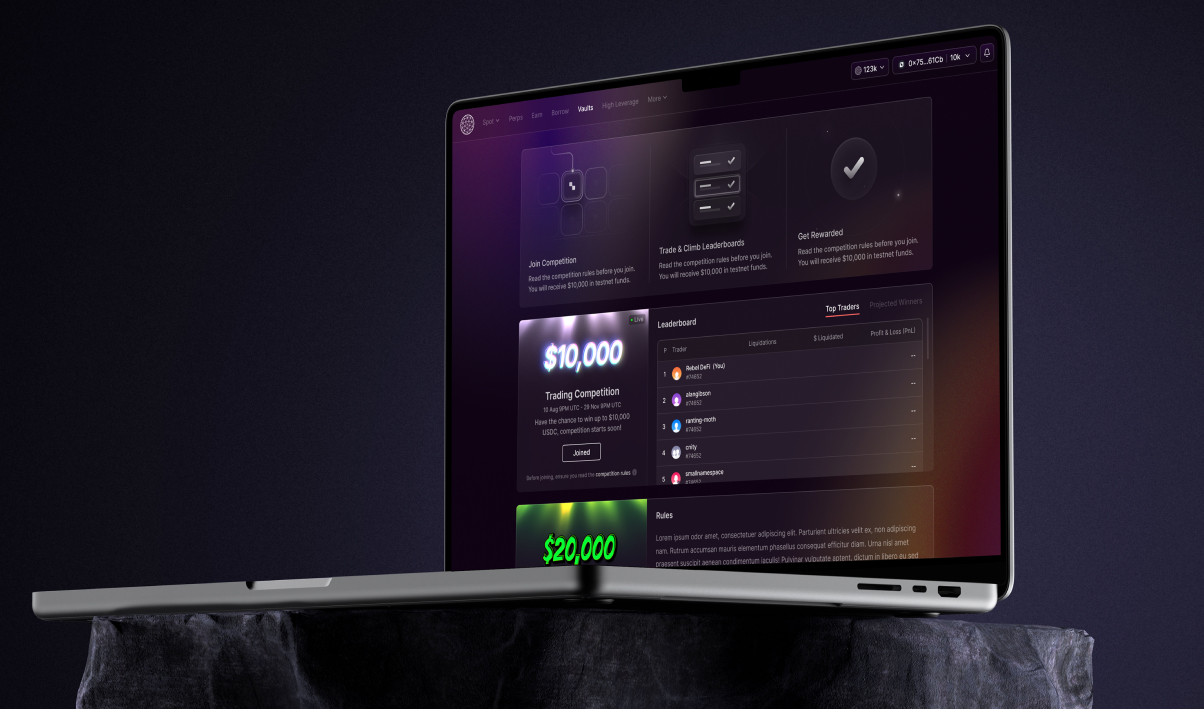

Mars Protocol — a unified, cross-collateralised leverage platform for DeFi

Mars Protocol brings leveraged yield, perps, spot and margin trading, lending, and managed vaults into a single Credit Account that cross-collateralises assets for capital efficiency, clear risk controls, and a fast, on-chain UX. End-to-end product design covering discovery, IA, flows, interaction design, visual design, UX writing, design system, and validation with power users. Partnered daily with protocol engineers and risk researchers; contributed to docs structure and UI components for new features.

Project Length

2021 - 2025

Platform

Web

Discovery and Framing

I mapped two core behaviours. One group optimised for capital efficiency and speed. The other prioritised clarity and predictability. I designed for both by making advanced actions quick, while keeping risk mechanics visible and inspectable. I wrote microcopy that explains why a limit exists, not just that it exists. I kept repeated actions on one screen and used drawers for deeper detail.

Show risk before action, not after.

Principle 1

Risk Visibility

Keep composition to one or two decisive clicks.

Principle 2

Efficiency

Reuse patterns across features so learning transfers.

Principle 3

Pattern Reuse

Make technical limits first-class UI, not footnotes.

Principle 4

Technical Transparency

Information Architecture

I flattened navigation into Portfolio, Trade, Earn, Strategies, Activity and Risk. Credit Account is the home for positions and Health Factor. Trade contains Perps and Spot with Margin. Earn contains Lending and Borrowing, plus LP entry. Strategies surfaces High Leverage Strategies and Managed Vaults. I added a global Parameters and Caps drawer so users can check Max LTV, Liquidation LTV, open interest caps and deposit caps without leaving their task.

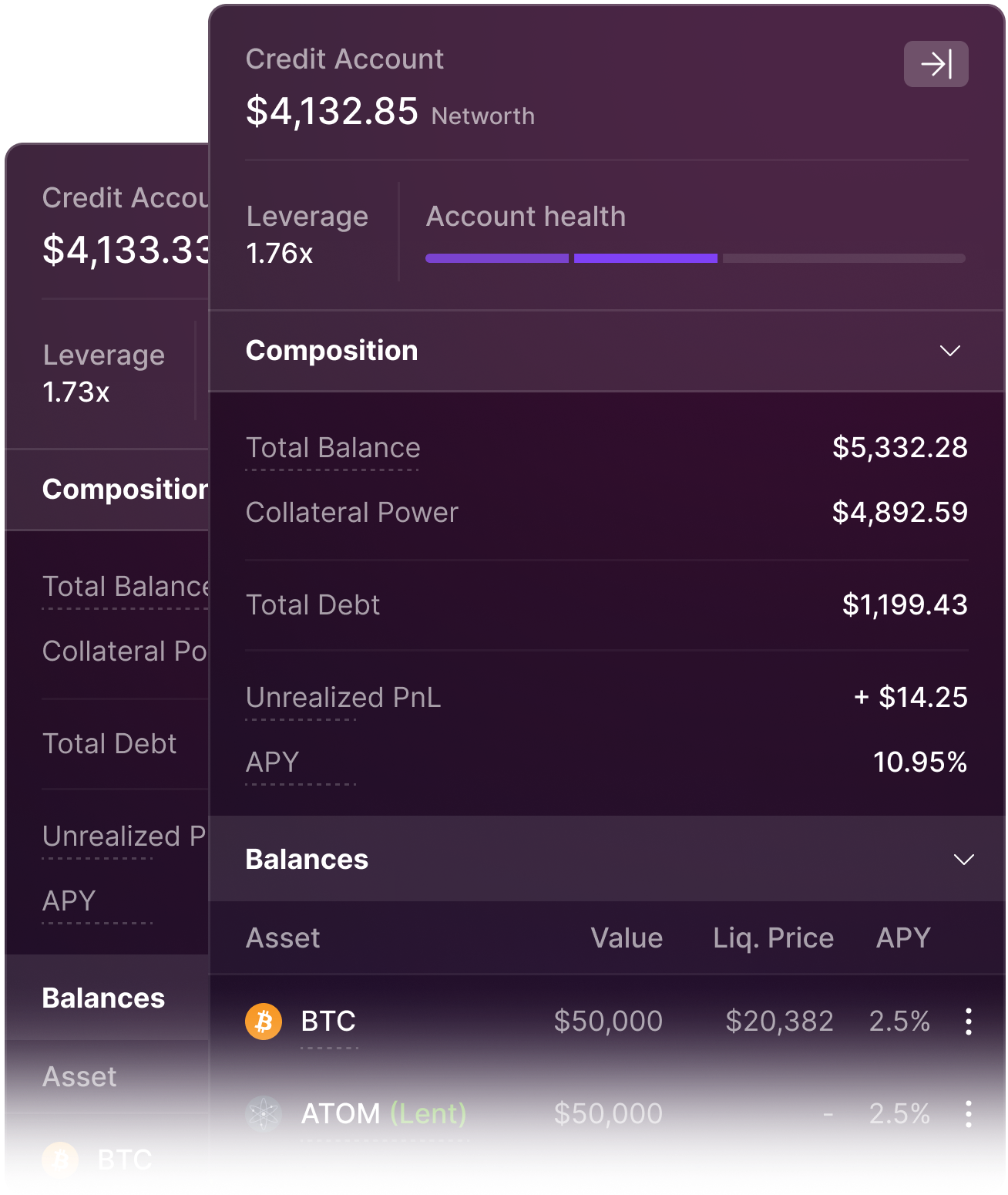

Credit Manager

I designed the Credit Account as a single source of truth where collateral, debt, PnL and actions sit together, with Health Factor always in view. HF is the anchor for every decision, so it updates in real time as users stage leverage or orders, and it is paired with clear Maximum LTV and Liquidation LTV markers to show the safety buffer at a glance. I avoided dense warnings by using concise labels, a simple bar with two ticks, and a short "learn more" drawer for those who want the mechanics. When liquidation price is only an estimate because multiple positions interact, I state that plainly rather than pretending to be exact. Colour is restrained and only signals proximity to risk, not excitement. The result feels quick for power users while keeping the cost of leverage visible before they press confirm.

Trading & DeFi Features

Comprehensive suite of trading tools designed for capital efficiency and clarity